Just to get the blog up to speed, here's a brief timeline of relevant events in the year and a half long real estate investing experiment (I'll go into some of these into greater detail in future posts):

Summer 2005: Cubicle-mate points out our office's resident realtor, says he's made millions in real estate investing [then why in the hell is he working here, I wonder...], and has a huge house and three cars (two Jags!). I go, "Hmm, you know, I've always wanted to get into real estate investing, but have no money at all, oh well..." Cubicle-mate takes this as a sign he needs to set up a meeting with me and said realtor. Meeting goes down, realtor/co-worker explains how if my credit is alright, I can buy a house with no money down (getting the seller to pay all closing costs) and would qualify for a 100% financed, interest-only loan. At this time, you may recall (dear reader), the U.S. real estate market was absolutely insane, but people thought it would continue to rise.

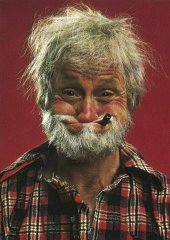

Meanwhile, in a secret underground lair, Alan "Cobra Commander" Greenspan cackled with glee at his evil thoughts...

August 2005: After a whirlwind housing market search with my realtor/co-worker, I settle on a three-level, three-bedroom townhouse with a rooftop deck in the Arlington (VA) area. The seller has it listed for $409,000. I get into somewhat of a bidding war with a kindly old Asian gentleman (NOTE: MISTAKE/LESSON #1 - DON'T GET INTO A BIDDING WAR WHEN REAL ESTATE INVESTING). We artificially inflated the price to $444,900, with the difference between the $420,000 winning bid representing the money back I would be getting from the seller, for closing costs and for blow, hookers, and an XBox (just kidding, I'm a Nintendo man). Closing day comes and goes, and I officially become a real estate investor. Hot Damn! I take my new house keys over to the place, and, in what would be a harbinger of things to come, notice that the air conditioner has broken.

September 2005 (Don't worry, I'm not going month by month here): As Alan Greenspan laughs maniacally and raises rates (I blame the blow and hookers), I begin my search for tenants. Having zero experience in this realm, I turn to Craigslist, and eventually find three willing subjects. They each rent a room in the place, for varying rents depending on their rooms. None of the three know each other, but are perfectly willing to throw caution to the wind and move in together, without meeting at all. Who knew people did this?? Not me. Anyway, two of them have pets (one girl had a dog and a cat, and the other girl had a kitten), so I charge them a pet deposit, and think little of it.

October - December 2005: The tenants are paying everything on time, and, aside from the A/C, little to no maintenance is needed. Greenie raises the rates again, but, hell, they're still low. Real estate investing is easy!!!

Christmas-ish 2005: So easy, in fact, and so potentially profitable (according to my realtor, the price of comparable houses in my zip code (or, "comps") had gone up significantly, meaning my house was now worth $465,000, at least! I decide I need to ring in 2006 with a new house (or two or three). I mean, if it doesn't cost anything. I also start telling everybody about my newfound money making scheme, trying to recruit others into my little game (much like how a heroin addict will try to bring others into their addiction - I'm looking your way Pete Doherty!) Oh, anyway MISTAKE/LESSON #2 - KEEP YOUR DUMB-ASS SCHEMES TO YOURSELF, THIS WAY YOUR SUCCESSES SEEM GREATER AND YOUR FAILURES ARE LESS PUBLIC.

To be continued in part II, in which our hero discovers a foppish bit of flim-flammery and has an epic showdown with Baron von Greenspan...

Tuesday, January 9, 2007

But first...a recap (part 1)

Labels:

Alan Greenspan,

estate,

invest,

Nintendo,

real estate,

rent,

XBox

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment